North Dakota workplace discrimination trial set for 2019

A racial discrimination lawsuit brought by six workers on a North Dakota job site is set for trial in late 2019. Continue reading

Valeant Unit Settles Sex Discrimination Claims For $7.2M

Law360, Los Angeles (July 12, 2016, 4:56 PM EDT) — Valeant-owned Medicis Pharmaceutical Corp. will pay $7.2 million to settle a class action alleging gender discrimination and other claims brought by female sales representatives of the medical cosmetics company, according to a final settlement order signed by a D.C. federal judge Monday. Continue reading

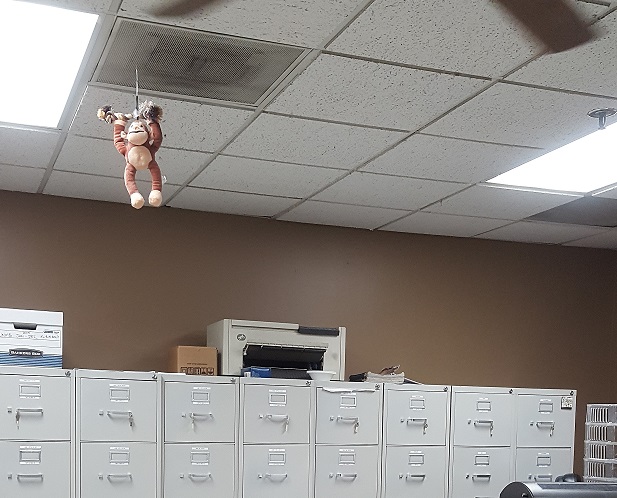

Hanging Monkey, Racial Graffiti, Among Evidence in Harassment Lawsuit

A stuffed monkey hanging from the ceiling in the shipping department at Univar USA’s Dallas distribution chemical facility is part of the evidence two Dallas men are providing in their lawsuit alleging racial harassment by some co-workers.

Continue reading

EEOC Puts New Limits on Criminal Background Checks

The Equal Employment Opportunity Commission (EEOC) has recently clarified its regulations regarding how employers use criminal background checks when making the decision whether or not to hire an individual. The EEOC’s decision to clarify those regulations apparently came about as a result of the organization’s long standing concern that criminal history and race are too often associated when employers make hiring decisions. While the EEOC issued a clarification, not a game-changing reinterpretation, it is important for employers and employees to understand these regulations.

Criminal History Should Not Affect Employment

In broad strokes, the EEOC suggests that criminal history should not be a factor in a hiring decision. However, the organization recognized that, in some cases, criminal history is a required factor of consideration in some segments of the American workplace. As such, the Equal Employment Opportunity Commission has set up a series of best practices designed to prevent or alleviate how an individual’s criminal history may affect a hiring decision.

Background Checks are Not Forbidden

According to Title VII, criminal background checks are not forbidden. In fact, it would be legally impossible to eliminate criminal history as a consideration for hiring in every job in the US economy. For instance, sex offenders must be legally screened from working as teachers in public schools, Banks might require that fraud and larceny not be a part of an employee’s recent past.

Criminal History as a Factor in the Hiring Decision

However, the EEOC’s intent in this clarification appears to be a desire to minimize the importance of criminal history in hiring decisions. But what was the driving factor behind this clarification policy, and how does it relate to Title VII, which says nothing about discriminating against employees on the basis of criminal record? The driving force, according to the Equal Employment Opportunity Commission, was race.

Criminal History and Race Discrimination

Title VII regulations’ prohibition against race discrimination may be, according to the EEOC, inexorably linked. The organization posits that criminal history may be used as a protective shield by companies so that they might discriminate racially, especially against African American and Hispanic individuals. If a company amplifies the negative impact of an individual’s criminal background as a smokescreen for racial discrimination, then Title VII regulations have been violated.

If you feel you were turned down for a job due to racial discrimination and inappropriate factoring of your criminal background, you need to speak to a lawyer. Call the law offices of Valli, Kane & Vagnini to find out how we can help.

Transgender Cases Now Included in Gender Discrimination Interpretation of Title VII

The Civil Rights Act of 1964 changed the landscape of human rights across the country. Title VII is the most hotly debated portion of that law in that it forbids discrimination based on five key metrics: race, color, religion, sex and national origin. In spite of the law’s nearly fifty years as a part of United States Code, it still requires active, repeated interpretation to ensure proper enforcement. The Equal Employment Opportunity Commission is responsible for making sure that act is enforced. Since Title VII’s inception, the EEOC has never ruled that transgender individuals are covered under the sexual discrimination cause of that Act—until April 2012.

Past EEOC Rulings Regarding Transgender Sexual Discrimination

Has discrimination on the basis of gender alignment always been a Title VII issue? Historically, it has not. In the past, when complaints were filed with the EEOC regarding discrimination against gay, lesbian, bisexual or transgender individuals, the complaint was handled as discrimination on the basis of sexual orientation. On three past occasions ranging from 1984 to 1986, the EEOC ruled that transgender discrimination did not constitute a Title VII claim. In April 2012, as the EEOC reviewed a complaint by Mia Macy against the Bureau of Alcohol, Tobacco, Firearms and Explosives, the EEOC ruled differently. As a result, transgender complaints are now considered under the purview of Title VII.

What is Gender Discrimination?

Gender discrimination under Title VII occurs when employment opportunities are denied or the terms and conditions of one’s employment are altered due to an individual’s gender. The interpretation of the law, previous to 2012, has excluded transgender individuals. The new interpretation of the law is important to the transgender community and for Title VII law. As an interpretation of an existing law, it may fundamentally modify the legal system’s understanding of gender.

When is Gender Discrimination Appropriate Under the Law?

Are there situations where gender discrimination is deemed legally appropriate? Yes, there are. Gender preferences are permissible when an employer takes an affirmative action hiring policy to rectify past discrimination. In addition, there are narrow cases where gender discrimination is inherent to the working conditions, i.e. male or female modeling, etc.

A Time of Change in Transgender Rights

With this important EEOC ruling regarding transgender discrimination under Title VII, the American legal understanding of transgender rights is in flux. If you would like to find out more about the rights and actions surrounding an act of transgender discrimination, contact Valli, Kane & Vagnini for a free consultation.

What To Do If Being Harassed At Work

Those who suffer sexual harassment in the workplace do not have to tolerate the behavior; there are options. However, people who suffer through sexual harassment in the workplace are often hesitant to report the behavior. They are intimidated by the fear that reporting this degrading and demeaning behavior could have negative consequences. These feared consequences could include termination, damage to prospects of future employment, demotions and negative transfers. These potential negative consequences can be mitigated by empowering the sexually harassed individual to stop the behavior and demand redress for the professional and emotional distress as a result of the illegal behavior.

Those who suffer sexual harassment in the workplace do not have to tolerate the behavior; there are options. However, people who suffer through sexual harassment in the workplace are often hesitant to report the behavior. They are intimidated by the fear that reporting this degrading and demeaning behavior could have negative consequences. These feared consequences could include termination, damage to prospects of future employment, demotions and negative transfers. These potential negative consequences can be mitigated by empowering the sexually harassed individual to stop the behavior and demand redress for the professional and emotional distress as a result of the illegal behavior.

Sexual Harassment and Employment Law

Sexual harassment falls under the federal employment discrimination laws. In many areas, it not only violates United States federal law, but state and local laws. Employers are obligated to take action to prevent sexual harassment at the workplace. If sexual harassment is reported to the employer, immediate action must be taken to deal with the situation. In addition, the employee reporting sexual harassment is legally protected from retaliation by the employer.

What is Sexual Harassment?

Sexual harassment comes in many forms. Some of these forms include:

- Being directly asked for sex or sexual contact.

- Unwanted and unwelcome sexual advances. This can be requests for dates or requests for meeting outside of the workplace.

- Sexually charged speech.

- Physical contact of a sexual nature.

- Being required to function in a hostile work environment.

- Behavior deemed inappropriate to the workplace. This includes sexist and derogatory language and pornographic images in the workplace.

- Discriminatory and unfair treatment, including denial of opportunities and promotion, based on gender.

Should I Pursue a Sexual Harassment Lawsuit?

Individuals victimized by sexual harassment are often reluctant to pursue a lawsuit. They are often caught in the dilemma of fearing the potential of negative consequences of reporting sexual harassment, while knowing that action must be taken. Attorneys experienced in sexual harassment cases take great care in the way they treat clients that have been victims of harassment. Great attention will be given to the privacy of the client. And, if possible, the case will be pursued on a completely private basis through negotiations with the employer or through filings with agencies such as the EEOC which are charged with the responsibility of investigating claims of such harassment.

Whether it is sexual harassment or other forms of discrimination in the workplace, it is important to understand the rights and legal options of the worker. If an employer has violated your rights, set up a no cost consultation with a law firm that is experienced in workplace discrimination.

The Job Search and Discrimination by Age

When employers shut you out because you exceed some arbitrary age limit, this can be exceedingly frustrating. Not only is the employer perpetrating an obvious injustice, in many cases, it may be clear that you are best candidate for the position. There are laws prohibiting many types of discrimination. U. S. Equal Employment Opportunity Commission (EEOC) enforces these laws. It behooves an employer to know the relevant laws and regulations. Age is one of the areas of discrimination covered by laws.

Employers are not to treat job applicants or existing employees less favorably because of their age. Current law, covered by Age Discrimination in Employment Act of 1967 (ADEA), applies to employees and job candidates equally. The law applies to people age forty and over. Employers can favor an older employee over a younger employee but not the other way around. The law applies even if both employees are over forty. In other words you cannot hire a 45 year old worker over a 55 year old employee due to age.

Work Contexts and Age Discrimination

The law covers discrimination in many aspects including hiring, termination, pay level and pay raises, work assignments, promotions, layoffs, benefits, training and general working conditions.

The law covers discrimination in many aspects including hiring, termination, pay level and pay raises, work assignments, promotions, layoffs, benefits, training and general working conditions.

Harassment and Age Discrimination

Law forbids harassment due to age. Examples of such harassment could include offensive remarks about a workers age. Harassment is not everyday good-humored banter or an isolated remark. However, if the banter and remarks become so severe and frequent that it creates a work environment that is hostile or offensive, that is harassment and prohibited by law. If the adverse treatment due to age results in negative employment decisions, such as termination, that is considered harassment and prohibited by law. It will be considered harassment if it is the victim’s manager or supervisor, a coworker or even someone who is not an employee such as client or vendor.

Policies, Practices and Age Discrimination

Policies and practices implemented by an employer need to be applied to everyone without regard to age. When applied, policies and practices can be illegal if they can be shown to have harmed or impacted negatively employees forty year old or older due to their age. Areas commonly effected include:

- Training and apprenticeship programs.

- Want ads and job notices.

- Employment inquiries.

- Benefits and retirement policies.

Any employer with more than twenty employees is subject to the Age Discrimination in Employment Act. It also applies to all government agencies, federal, state and local.

Is Your Employer Passing You Off As An Independent Contractor?

When you provide services for pay, your employment status is that of either an “employee” or an “independent contractor“. Your employment status is important since employment law treats employees and independent contractors very differently. As New York employment law attorneys point out, these differences give employers many administrative and financial incentives to (mis)classify you as independent contractors when employers should classify you as an employee.

When you provide services for pay, your employment status is that of either an “employee” or an “independent contractor“. Your employment status is important since employment law treats employees and independent contractors very differently. As New York employment law attorneys point out, these differences give employers many administrative and financial incentives to (mis)classify you as independent contractors when employers should classify you as an employee.

New York employment law attorneys put it in simple terms, when an employer classifies you as an independent contractor there is no benefits package, including no overtime pay, sick days, vacations days, health insurance or pensions. The employer does not have to withhold taxes from your pay and avoids paying unemployment insurance, Medicare and Social Security for those workers. Employers provide independent contractors with an Internal Revenue Service (IRS) Form 1099 in place of the Form W-2. Independent contractors are not protected under The Fair Labor Standards Act (FLSA).

Employers can suffer serious consequences for misclassifying employees as independent contractors. Failure to classify properly an employee can lead to substantial financial liability. In addition to retroactive wages and benefits owed the misclassified employees, there are taxes, substantial fines and penalties involved. Areas that misclassification can effect include:

- Worker injury claims. If an injury occurs on the job, state workers’ compensation laws usually provide compensation for the injured party. If an independent contractor files a claim and is determined to be an employee of the organization, it could result in civil action and fines against the employer.

- Worker unemployment claims. In some states, unemployment compensation claims by workers classified as independent contractors may trigger an audit of the employer. If the audit finds misclassification, the employer is liable.

- Discrimination claims. Though anti-discrimination law has not generally afforded protection to independent contractors, caution is in order. Some courts have allowed the protection to spill over to include independent contractors.

- Federal tax liability. The adjective that comes up most often to describe the financial liability for misclassification of employees is “onerous”.

- Third party liability. Responsibility for injured third parties may hang on the determination if a worker is properly classified. A word of caution to employers: Some courts have found that using independent contractors does not shield an employer from liability.

State and federal officials have stepped up their pursuit of companies trying to pass off their employees as independent contractors. If you are located in New York and believe an employer has misclassified you as an independent contractor, you may be entitled compensation and should contact New York employment law attorneys for a consultation.

State and federal officials have stepped up their pursuit of companies trying to pass off their employees as independent contractors. If you are located in New York and believe an employer has misclassified you as an independent contractor, you may be entitled compensation and should contact New York employment law attorneys for a consultation.

Dionne v. Floormasters Enterprises, Inc. and the FLSA.

The 11th Circuit Court of Appeals, which controls Florida, Georgia, and Alabama, recently ruled that plaintiffs may not recover attorney fees, as they normally would be entitled to under the Fair Labor Standards Act (FLSA), in situations where the defendant-employer pays plaintiffs all the actual damages, liquidated damages, and interest owed to them outside of a negotiated settlement. In Dionne v. Floormasters Enterprises, Inc., the plaintiff filed a lawsuit alleging overtime violations by the defendant. The total amount of damages sought by the plaintiff, including liquidated damages as provided under the FLSA and interest, amounted to $3,000. After the plaintiffs filed the suit, the defendant tendered a payment to the plaintiff for the full amount they were seeking, “in the interests of expeditious resolution of Plaintiff’s claim and efficient use of this Court’s time and resources.” After tendering this payment, the defendant moved to dismiss the claim as moot, since even if the employer was found to be liable, the employer would not have to pay any additional amount to the plaintiff. The court granted the defendant’s motion, dismissing the case with prejudice. However, the employer did not compensate the plaintiff for attorney’s fees and costs, and the court’s dismissal of the case means that the employer’s liability for its illegal conduct was never established.

The 11th Circuit Court of Appeals, which controls Florida, Georgia, and Alabama, recently ruled that plaintiffs may not recover attorney fees, as they normally would be entitled to under the Fair Labor Standards Act (FLSA), in situations where the defendant-employer pays plaintiffs all the actual damages, liquidated damages, and interest owed to them outside of a negotiated settlement. In Dionne v. Floormasters Enterprises, Inc., the plaintiff filed a lawsuit alleging overtime violations by the defendant. The total amount of damages sought by the plaintiff, including liquidated damages as provided under the FLSA and interest, amounted to $3,000. After the plaintiffs filed the suit, the defendant tendered a payment to the plaintiff for the full amount they were seeking, “in the interests of expeditious resolution of Plaintiff’s claim and efficient use of this Court’s time and resources.” After tendering this payment, the defendant moved to dismiss the claim as moot, since even if the employer was found to be liable, the employer would not have to pay any additional amount to the plaintiff. The court granted the defendant’s motion, dismissing the case with prejudice. However, the employer did not compensate the plaintiff for attorney’s fees and costs, and the court’s dismissal of the case means that the employer’s liability for its illegal conduct was never established.

On appeal, the plaintiff argued that it was owed attorney’s fees, which go above and beyond the $3,000 that the defendant tendered. The FLSA provides attorney fees for the plaintiff, if the plaintiff proves that the employer violated the FLSA wage and overtime laws in his or her suit. Since the only reason that the defendant paid any amount to the plaintiff is that the plaintiff brought a lawsuit, the plaintiff felt he was entitled to the reasonable attorney’s fees that he incurred in bringing the suit and facilitating the payment.

The 11th Circuit Court of Appeals decided that this is a classic application of “catalyst” test, which states that “a plaintiff should be found as prevailing if its ends are accomplished as a result of the litigation even without formal judicial recognition, there is a causal connection between the plaintiff’s lawsuit and the defendant’s actions provided relief to the plaintiff, and the defendant’s actions were required by law.” However, the Court notes, the Supreme Court rejected the “catalyst” test in 2001 in Buckhannon Board & Care Home, Inc. v. West Virginia Department of Health & Human Resources, which requires that plaintiffs demonstrate that such a payment alters the legal relationship between the party’s in order for the plaintiff to be considered the “prevailing party.”

The 11th Circuit Court of Appeals decided that this is a classic application of “catalyst” test, which states that “a plaintiff should be found as prevailing if its ends are accomplished as a result of the litigation even without formal judicial recognition, there is a causal connection between the plaintiff’s lawsuit and the defendant’s actions provided relief to the plaintiff, and the defendant’s actions were required by law.” However, the Court notes, the Supreme Court rejected the “catalyst” test in 2001 in Buckhannon Board & Care Home, Inc. v. West Virginia Department of Health & Human Resources, which requires that plaintiffs demonstrate that such a payment alters the legal relationship between the party’s in order for the plaintiff to be considered the “prevailing party.”

Since the plaintiff is not considered the “prevailing party” as decided in a court of law, it reasons that the plaintiff is not entitled to attorney’s fees as provided by statute.

Even though the 11th Circuit here seems to break new ground, the facts of this case may limit its applicability going forward. For example, the Court distinguishes cases in which plaintiffs are awarded lawyer’s fees and costs following the court’s dismissal of the plaintiff’s claims, where the dismissals incorporate the terms of a settlement between the parties. It is very likely that where there is a settlement between the parties that has been incorporated into a court order, Dionne may not apply. This is supported by the Supreme Court in Buckhannon, which states that judicial imprimatur, or the court’s seal of approval, is a necessary part of establishing a prevailing party in a lawsuit.

Importantly, in this case, the defendant never admitted liability, paid the full amount of damages sought by plaintiffs (including unpaid wages, liquidated damages, and interest), and never entered into a settlement agreement, let alone a settlement agreement that was entered as a court order. For this holding to be applied against plaintiffs in the future, a defendant would have to provide the full amount of unpaid wages, liquidated damages, and interest sought by the plaintiff. While in this case that amount was only $3,000, in many cases that amount may be much higher, and many defendants may be unwilling to pay the entire amount of the damages that plaintiffs seek in lieu of a negotiated settlement.

Importantly, in this case, the defendant never admitted liability, paid the full amount of damages sought by plaintiffs (including unpaid wages, liquidated damages, and interest), and never entered into a settlement agreement, let alone a settlement agreement that was entered as a court order. For this holding to be applied against plaintiffs in the future, a defendant would have to provide the full amount of unpaid wages, liquidated damages, and interest sought by the plaintiff. While in this case that amount was only $3,000, in many cases that amount may be much higher, and many defendants may be unwilling to pay the entire amount of the damages that plaintiffs seek in lieu of a negotiated settlement.