DALLAS – DaVita Rx LLC, a nationwide pharmacy that specializes in serving patients with severe kidney disease, agreed to pay a total of $63.7 million to resolve False Claims Act allegations relating to improper billing practices and unlawful financial inducements to federal healthcare program beneficiaries, the Justice Department announced today. DaVita Rx is based in Coppell, Texas.

The settlement resolves allegations that DaVita Rx billed federal healthcare programs for prescription medications that were never shipped, that were shipped but subsequently returned, and that did not comply with requirements for documentation of proof of delivery, refill requests, or patient consent. In addition, the settlement also resolves allegations that DaVita paid financial inducements to Federal healthcare program beneficiaries in violation of the Anti-Kickback Statute. Specifically, DaVita Rx allegedly accepted manufacturer copayment discount cards in lieu of collecting copayments from Medicare beneficiaries, routinely wrote off unpaid beneficiary debt, and extended discounts to beneficiaries who paid for their medications by credit card. These allegations relating to improper billing and unlawful financial inducements were the subject of self-disclosures by DaVita Rx and a subsequently filed whistleblower lawsuit.

“Providers should not make patient care decisions based upon improper financial incentives or encourage their patients to do the same,” said U.S. Attorney Erin Nealy Cox for the Northern District of Texas. “The U.S. Attorney’s Office has and will continue to work cooperatively with providers that bring such issues to light to redress the losses the federal healthcare system has incurred.”

DaVita Rx has agreed to pay a total of $63.7 million to resolve the allegations in its self-disclosures and the whistleblower lawsuit. DaVita Rx repaid approximately $22.2 million to federal healthcare programs following its self-disclosure and will pay an additional $38.3 million to the United States as part of the settlement agreement. In addition, $3.2 million has been allocated to cover Medicaid program claims by states that elect to participate in the settlement. The Medicaid program is jointly funded by the federal and state governments.

“Improper billing practices and unlawful financial inducements to health program beneficiaries can drive up our nation’s health care costs,” said Civil Division Acting Assistant Attorney General Chad Readler. “The settlement announced today reflects not only our commitment to protect the integrity of the healthcare system, but also our willingness to work with providers who review their own practices and make appropriate self-disclosures.”

“The conduct being resolved in this matter presents serious program integrity concerns” said CJ Porter, Special Agent in Charge for the Office of Inspector General of the U.S. Department of Health and Human Services, “DaVita Rx’s cooperation in the investigation of this matter was necessary and appropriate to reach this resolution.”

The lawsuit resolved by the settlement was filed by two former DaVita Rx employees, Patsy Gallian and Monique Jones, under the qui tam, or whistleblower, provisions of the False Claims Act, which permit private parties to sue on behalf of the government when they discover evidence that defendants have submitted false claims for government funds and to receive a share of any recovery. The case is captioned United States ex rel. Gallian v. DaVita Rx, LLC, No. 3:16-cv-0943-B (N.D. Tex.). The relators will receive roughly $2.1 million from the federal recovery.

The settlement of this matter illustrates the government’s emphasis on combating health care fraud. One of the most powerful tools in this effort is the False Claims Act. Tips and complaints from all sources about potential fraud, waste, abuse, and mismanagement can be reported to the Department of Health and Human Services, at 800-HHS-TIPS (800-447-8477). HHS also offers several programs for health care providers to self-report potential fraud. More information on self-disclosure processes can be found on the HHS-OIG website.

The investigation was conducted by HHS-OIG, the Civil Division’s Commercial Litigation Branch and the U.S. Attorney’s Office for the Northern District of Texas. The claims asserted by the government are allegations only and there has been no determination of liability.

Assistant U.S. Attorney Lisa-Beth C. Meletta handled this matter for the U.S. Attorney’s Office.

Read the original article from the Department of Justice

FDNY sued for discrimination — again

Nearly three years after the city agreed to pay $98 million to settle claims of bias in its hiring of black and Hispanic firefighters, New York’s Bravest is being sued for discrimination again.

Continue reading

Valeant Unit Settles Sex Discrimination Claims For $7.2M

Law360, Los Angeles (July 12, 2016, 4:56 PM EDT) — Valeant-owned Medicis Pharmaceutical Corp. will pay $7.2 million to settle a class action alleging gender discrimination and other claims brought by female sales representatives of the medical cosmetics company, according to a final settlement order signed by a D.C. federal judge Monday. Continue reading

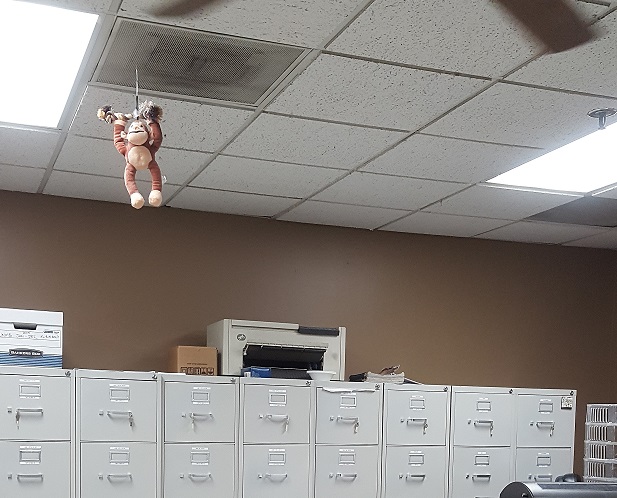

Hanging Monkey, Racial Graffiti, Among Evidence in Harassment Lawsuit

A stuffed monkey hanging from the ceiling in the shipping department at Univar USA’s Dallas distribution chemical facility is part of the evidence two Dallas men are providing in their lawsuit alleging racial harassment by some co-workers.

Continue reading

Let the Mother Beware: Pregnancy in the Workplace

It is somewhat hard to believe in this day and age that women experiencing pregnancy in the workplace are still being subjected to workplace policies that put their livelihood in jeopardy. Despite federal laws dating back to the Civil Rights Act of 1964 and several updates and addendums, there are still employers in the United States that have written policies that terminate workers due to pregnancy, regardless of the ability to perform that job’s duties and the overall physical capabilities of the workers.

A recent case in point was brought by the EEOC against a Baytown, Texas, restaurant chain called Bayou City Wings. Acting on behalf of a former employee named Maryann Castillo and eight other dismissed workers, the EEOC claimed that Bayou City Wings, and its parent company, JC Wings Enterprises, LLC, operated with a discriminatory policy against their workers who were experiencing pregnancy in the workplace. Their written policy mandated laying off workers after their third month of pregnancy, regardless of the employees’ desire and ability to stay on the job. In this case, Castillo was not experiencing any difficulties performing her job duties and had received approval from her doctor to work up to her 36th week of pregnancy.

Despite the honorable desire of the employer to take responsibility for the well-being of the unborn babies in these cases, it is important to note that the law and previous Supreme Court cases have determined that it is not the responsibility of employers to make decisions to protect the well-being of the unborn children of their employees, but rather the sole responsibility of the mothers involved. For employers, this could be a release of guilt if a mother’s decision to work jeopardizes her unborn child. The true benefit for this is that the women carrying their children should be able to have control over what they can or cannot do, without the arbitrary decisions of companies that are driven by the bottom line.

The EEOC cannot be the only protector of these cases of injustice and discrimination in the workplace. It is important for all employees, and especially women, to know their rights in a situation where they are facing a pregnancy in the workplace. Under the laws of this country, mothers-to-be are protected and have the law on their side. The Law offices of Valli, Kane, and Vagnini are specially equipped to help any victim of this or any other kind of discrimination in the workplace. Contact them for a free consultation to make sure that your rights are protected.

What To Do If Being Harassed At Work

Those who suffer sexual harassment in the workplace do not have to tolerate the behavior; there are options. However, people who suffer through sexual harassment in the workplace are often hesitant to report the behavior. They are intimidated by the fear that reporting this degrading and demeaning behavior could have negative consequences. These feared consequences could include termination, damage to prospects of future employment, demotions and negative transfers. These potential negative consequences can be mitigated by empowering the sexually harassed individual to stop the behavior and demand redress for the professional and emotional distress as a result of the illegal behavior.

Those who suffer sexual harassment in the workplace do not have to tolerate the behavior; there are options. However, people who suffer through sexual harassment in the workplace are often hesitant to report the behavior. They are intimidated by the fear that reporting this degrading and demeaning behavior could have negative consequences. These feared consequences could include termination, damage to prospects of future employment, demotions and negative transfers. These potential negative consequences can be mitigated by empowering the sexually harassed individual to stop the behavior and demand redress for the professional and emotional distress as a result of the illegal behavior.

Sexual Harassment and Employment Law

Sexual harassment falls under the federal employment discrimination laws. In many areas, it not only violates United States federal law, but state and local laws. Employers are obligated to take action to prevent sexual harassment at the workplace. If sexual harassment is reported to the employer, immediate action must be taken to deal with the situation. In addition, the employee reporting sexual harassment is legally protected from retaliation by the employer.

What is Sexual Harassment?

Sexual harassment comes in many forms. Some of these forms include:

- Being directly asked for sex or sexual contact.

- Unwanted and unwelcome sexual advances. This can be requests for dates or requests for meeting outside of the workplace.

- Sexually charged speech.

- Physical contact of a sexual nature.

- Being required to function in a hostile work environment.

- Behavior deemed inappropriate to the workplace. This includes sexist and derogatory language and pornographic images in the workplace.

- Discriminatory and unfair treatment, including denial of opportunities and promotion, based on gender.

Should I Pursue a Sexual Harassment Lawsuit?

Individuals victimized by sexual harassment are often reluctant to pursue a lawsuit. They are often caught in the dilemma of fearing the potential of negative consequences of reporting sexual harassment, while knowing that action must be taken. Attorneys experienced in sexual harassment cases take great care in the way they treat clients that have been victims of harassment. Great attention will be given to the privacy of the client. And, if possible, the case will be pursued on a completely private basis through negotiations with the employer or through filings with agencies such as the EEOC which are charged with the responsibility of investigating claims of such harassment.

Whether it is sexual harassment or other forms of discrimination in the workplace, it is important to understand the rights and legal options of the worker. If an employer has violated your rights, set up a no cost consultation with a law firm that is experienced in workplace discrimination.

Kudo v. Panda Express

This action was instituted to address a failure to pay overtime to General Managers of Panda Express Restaurants nationwide. The complaint alleges that General Managers across the country were required to work in excess of 40 hours per work week without overtime pay. The complaint further alleges that Panda Express misclassified these managers as exempt based on their titles alone and required them to perform the tasks of hourly workers such as ringing registers, serving food and cleaning the restaurant.

Downloads:

The Job Search and Discrimination by Age

When employers shut you out because you exceed some arbitrary age limit, this can be exceedingly frustrating. Not only is the employer perpetrating an obvious injustice, in many cases, it may be clear that you are best candidate for the position. There are laws prohibiting many types of discrimination. U. S. Equal Employment Opportunity Commission (EEOC) enforces these laws. It behooves an employer to know the relevant laws and regulations. Age is one of the areas of discrimination covered by laws.

Employers are not to treat job applicants or existing employees less favorably because of their age. Current law, covered by Age Discrimination in Employment Act of 1967 (ADEA), applies to employees and job candidates equally. The law applies to people age forty and over. Employers can favor an older employee over a younger employee but not the other way around. The law applies even if both employees are over forty. In other words you cannot hire a 45 year old worker over a 55 year old employee due to age.

Work Contexts and Age Discrimination

The law covers discrimination in many aspects including hiring, termination, pay level and pay raises, work assignments, promotions, layoffs, benefits, training and general working conditions.

The law covers discrimination in many aspects including hiring, termination, pay level and pay raises, work assignments, promotions, layoffs, benefits, training and general working conditions.

Harassment and Age Discrimination

Law forbids harassment due to age. Examples of such harassment could include offensive remarks about a workers age. Harassment is not everyday good-humored banter or an isolated remark. However, if the banter and remarks become so severe and frequent that it creates a work environment that is hostile or offensive, that is harassment and prohibited by law. If the adverse treatment due to age results in negative employment decisions, such as termination, that is considered harassment and prohibited by law. It will be considered harassment if it is the victim’s manager or supervisor, a coworker or even someone who is not an employee such as client or vendor.

Policies, Practices and Age Discrimination

Policies and practices implemented by an employer need to be applied to everyone without regard to age. When applied, policies and practices can be illegal if they can be shown to have harmed or impacted negatively employees forty year old or older due to their age. Areas commonly effected include:

- Training and apprenticeship programs.

- Want ads and job notices.

- Employment inquiries.

- Benefits and retirement policies.

Any employer with more than twenty employees is subject to the Age Discrimination in Employment Act. It also applies to all government agencies, federal, state and local.

Workers Adjustment and Retraining Notification Act (WARN)

The Workers Adjustment and Retraining Notification Act (“WARN”) became effective on February 4, 1989. WARN requires employers to give employees notice when an employment change is advanced. The Act calls for at least sixty (60) days notice to employees who will experience employment loss either because of a plant closing or because of a scheduled mass layoff.

The Workers Adjustment and Retraining Notification Act (“WARN”) became effective on February 4, 1989. WARN requires employers to give employees notice when an employment change is advanced. The Act calls for at least sixty (60) days notice to employees who will experience employment loss either because of a plant closing or because of a scheduled mass layoff.

An employee experiences employment loss in any one of the following three scenarios:

- An employment termination, other than a discharge for cause, voluntary departure, or retirement;

- A layoff exceeding six (6) months;

- A reduction in an employee’s hours of work of more than fifty (50) percent per month for a period of six (6) months.

WARN covers employers who have more than one hundred (100) employees. Employees who work less than six (6) of the past twelve (12) months, as well as employees who work less than twenty (20) hours a week are not counted into this total. Private for profit or non-profit, as well as public and quasi-public entities who operate in the commercial context are obligated under WARN to give their employees notice pending a plant closing or mass layoff. Federal, State or local government entities are governed under WARN. Hourly, salaried, managerial and supervisory employees are all entitled to the sixty (60) day notice. Business partners however, are not entitled to the Act’s protections.

Employers of a temporary project are not required to give their employees notice prior to plant closings or mass layoffs. Additionally, if the closing of the plant or mass layoff is the result of completion of a project, those workers are also not entitled to WARN’s protection. The employees must have been hired with the understanding that their employment was conditional on the completion of the project. An employer cannot label an ongoing project as temporary to avoid the requirements under the WARN act. Additionally, striking employees are not entitled to notice when their actions lead to a lockout, which acts as an equivalent to a closing or mass layoff. Non-striking employees who are adversely affected are entitled to notice.

Employers of a temporary project are not required to give their employees notice prior to plant closings or mass layoffs. Additionally, if the closing of the plant or mass layoff is the result of completion of a project, those workers are also not entitled to WARN’s protection. The employees must have been hired with the understanding that their employment was conditional on the completion of the project. An employer cannot label an ongoing project as temporary to avoid the requirements under the WARN act. Additionally, striking employees are not entitled to notice when their actions lead to a lockout, which acts as an equivalent to a closing or mass layoff. Non-striking employees who are adversely affected are entitled to notice.

If fifty (50) or more employees will experience employment loss (defined above) during any thirty (30) day period, then WARN requires employers to inform their employees. Part time employees and new employees are not included in this employee total. Advanced notice is also required when an employer has a mass layoff proposed. If during any thirty (30) day period, five-hundred (500) or more employees, or forty-nine (49) to five-hundred (500) employees, which make up thirty-three (33) percent of the workforce are going to be laid off, then the employer must give notice. The employee calculation for plant closings apply to mass layoffs as well (part time and new employees are not included in the total employee calculations).

If an employer plans to sell his business or is involved in the sale of the business, employees are still entitled to receive notice if a closing or mass layoff is proposed. It is the seller of the business’ responsibility to give sixty (60) days notice to his employees up to and including the date/time of the sale if there is a risk of employment loss. The buyer is responsible to provide employees with sixty (60) day notice of any proposed plant closing or mass layoff after the date/time of the sale. Notice that the business has been sold is not required unless a closing or mass layoff is in the works.

The employer must give notice to either the chief elected officer of exclusive represented employees, the labor union, or to unrepresented workers who may reasonably be expected to experience employment loss. Even employees who do not count towards employment totals, those workers who work less than twenty (20) hours a week or who have worked less than six (6) of the last twelve (12) months are still entitled to due notice. Notice must also be given to the State dislocated worker unit, as well as the chief elected officer of the local government where the employment site is located. There are, however, three exceptions to this requirement:

The employer must give notice to either the chief elected officer of exclusive represented employees, the labor union, or to unrepresented workers who may reasonably be expected to experience employment loss. Even employees who do not count towards employment totals, those workers who work less than twenty (20) hours a week or who have worked less than six (6) of the last twelve (12) months are still entitled to due notice. Notice must also be given to the State dislocated worker unit, as well as the chief elected officer of the local government where the employment site is located. There are, however, three exceptions to this requirement:

- If the employer is seeking new capital to stay open and advanced notice would ruin this opportunity, then notice is not required. This exception only applies to plant closings and not mass layoffs.

- If a plant closing or mass layoff was not reasonably foreseeable at the time notice is required, then the notice requirement is excused.

- If a plant closing or mass layoff is the result of a natural disaster, such as a flood, earthquake, drought or storm; notice is not required.

If an employer does not provide sixty (60) days notice, and relies on one of the exceptions listed above, the employer must prove that one of the exceptions did in fact take place.

While notice is required sixty (60) days in advance, there is no requirement delineating what that form must be. The notice must be in writing, but any reasonable method of delivery that will ensure receipt sixty (60) days prior to closing or mass layoff will suffice. The notice must specify the reasons for a plant closing or mass layoff. If either will occur more than fourteen (14) days after the date announced in the notice, then additional notice on behalf of the employer is required.

If you have been affected by a plant closing or mass layoff and your employer has not followed the requirements under the Worker Adjustment and Retraining Notification Act, contact Valli, Kane & Vagnini to learn more about your rights and legal options.

Understanding Pregnancy Discrimination and Your Rights as an Expecting Mother

Women shouldn’t

Women shouldn’t

have to fear for their jobs when starting a family. But, we hear about pregnancy discrimination in the workplace all the time. Companies frequently do not abide by the Pregnancy Discrimination Act of 1978 or the U.S. Department of Labor’s Family Medical Leave Act. Women are too often subject to unlawful actions made by employers because of pregnancy.

There are many different forms of pregnancy discrimination. The majority include: reassignment to a department out of your career path or a lower paying position, refusal of medical health care benefits that are available to other employees, or cutting your hours and pay during pregnancy.

Here are some things you should know about the laws protecting women, and the action you should take if you believe you have been discriminated against.

U.S. Department of Labor’s Family Medical Leave Act

Under this act, employers with 50 or more employees must give up to 12 weeks of unpaid leave to employees that have worked for the company for at least 12 months and have clocked a minimum of 1,250 hours of service. The FMLA regulates leave of absences that are necessary for one of the following reasons:

- Childbirth and infant care of the employee’s newborn

- Adoption or foster care placement with the employee

- A serious health condition of an immediate family member that requires care

- A serious health condition of the employee

Pregnancy Discrimination Act of 1978

The Pregnancy Discrimination Act of 1978 provides guidelines that employees and employers must follow during pregnancy to ensure that there are no discriminatory actions.

- An employer cannot refuse to hire you because of your pregnancy as long as you can complete the functions of the job

- If you are temporarily incapable of completing the tasks of your job because of your pregnancy, your employer must modify tasks and assignments (as done with other temporarily disabled employees).

- You must be permitted to work as long as you can complete the functions of your job.

- If you are provided with health insurance by your employer, the insurance must cover pregnancy-related expenses as it would for other medical conditions

- When crediting seniority, vacation time, pay increases or other benefits, you must be treated the same as other temporarily disabled employees.

If you feel you have been discriminated against, take these steps:

- Document any discriminatory conversations or occurrences. Detail the time and place, as well as participants and witnesses.

- Continue to perform your tasks and assignments, but start documenting how well you are performing.

- Compile a record of previous performance reviews to keep as evidence.

- Consider contacting your human resources department to file a complaint, and document your complaint within your own files.

- Contact an attorney to discuss your options

To prove you have been discriminated against, you must fit this criteria:

- Be a member of a protected class (as a woman, you are protected)

- Meet the expectations of your job and your performance was up to par with your employer’s demands (this can be proven with your performance reviews, raises, promotions and your own documentation of such material)

- Be fired, demoted, passed over for a promotion, not hired for a position, or suffered any other form of adverse action.

- Be treated differently or less favorably than other employees with similar circumstances who were not a member of a protected class.

In court, your employer must provide a legitimate and non-discriminatory reason for the adverse action. You must show that the employer’s reason is a pre-text (a false reason used to conceal the discriminatory action). If you are able to prove their rationale is pre-textual, you have a chance of winning in front of a judge or jury.

Contact an attorney to discuss your circumstances and further explore your legal options.